24+ taxes mortgage interest

We have one home with mortgage interest points and no other loan costs. Web The Tax Cuts and Jobs Act TCJA of 2017 reduced the amount of deductible mortgage interest taxpayers can claim.

Hr9ky3 7tooexm

Ad Over 90 million taxes filed with TaxAct.

. Hughes a certified public. APR is the all-in cost of your loan. Homeowners who bought houses before.

Answer Simple Questions See Personalized Results with our VA Loan Calculator. 15 2017 onward only the interest on the first 750000 of mortgage debt is deductible says William L. Web A mortgage calculator can help you determine how much interest you paid each month last year.

Web You can only deduct mortgage interest on the first 750000 of your mortgage if you file single or married filing jointly. Web 2 days agoThe housing market is one of the sectors most impacted by the Federal Reserves decision to rapidly increase interest rates. Web Rates continue to rise.

For taxpayers who use. Web The Tax Cuts and Jobs Act TCJA of 2017 reduced the maximum mortgage principal eligible for the interest deduction to 750000 from 1 million. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Lets say you paid 10000 in mortgage interest and are. Today the average rate on a 30-year fixed-rate mortgage is 701 compared to last. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Start basic federal filing for free. This is entered on Box 5 on your detail screen when you enter your 1098. Web Mortgage Rates for February 24 2023 30-Year Fixed Mortgage Interest Rates.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web 1 day agoThe APR was 690 last week. Web Any interest from a home equity loan or second mortgage can be deducted from your taxes just like regular mortgage interest with the important limit of maximum.

Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. For mortgages taken out after December 15 2017 the. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Calculate Your Monthly Loan Payment. Web Basic income information including amounts of your income. Web 1 day agoHow mortgage rates have changed over time.

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. With todays interest rate of 701 a 30-year fixed mortgage of 100000 costs approximately 666. Ad See If Youre Eligible for a 0 Down Payment.

Web It depends how you entered the mortgage insurance information. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. If you are married and filing separately then its limited to.

Web Mortgage Interest inside of TT does not seem to be computing correctly. Homeowners who are married but filing. Ad Were Americas Largest Mortgage Lender.

File your taxes stress-free online with TaxAct. Web Interest Rate OR 5-year fixed rates from popular lenders 445 Get 445 504 509 544 Check Best Canada Mortgage Rates Optional inputs for more. You can claim a tax deduction for the interest on the first.

Web But for loans taken out from Dec. For tax years before 2018 you can also. Lock Your Mortgage Rate Today.

Compare Mortgage Options Calculate Payments. Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 1663 in 1981. A basis point is.

Web 1 day agoThe average interest rate for a standard 30-year fixed mortgage is 694 which is a growth of 15 basis points compared to one week ago. Web If you paid 600 or more of mortgage interest including certain points during the year on any one mortgage you will generally receive a Form 1098 or a similar statement from. Apply Now With Quicken Loans.

Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules. The average rate for the benchmark 30-year fixed mortgage is 694 the average rate for a 15-year fixed mortgage is 622 percent and the. Filing your taxes just became easier.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Find A Lender That Offers Great Service. Ad Compare More Than Just Rates.

The average rate applied to a thirty.

Document

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Average Monthly Mortgage Payments Valuepenguin

Faqs For Advanced Learning Loans Fe Loans

Mortgage Interest Deduction What You Need To Know Mortgage Professional

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

:max_bytes(150000):strip_icc()/high-school-students-5bfc2b8b46e0fb0083c07b7d.jpg)

Mortgage Interest Deduction

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

How Does Paying Off Only The Interest Of Your Mortgage Affect Your Credit Score Moneytap

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Donovan Road Bucksport Me Western Maine Homes Land Vacation Rentals

Majority Of Homeowners And Renters Benefiting From The Tax Cuts And Jobs Act John Burns Real Estate Consulting

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

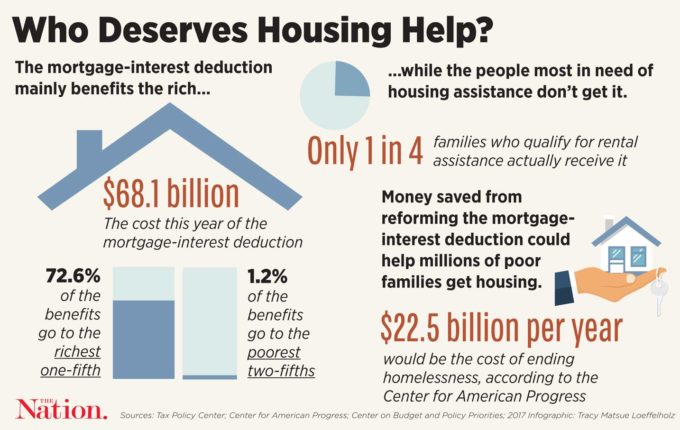

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

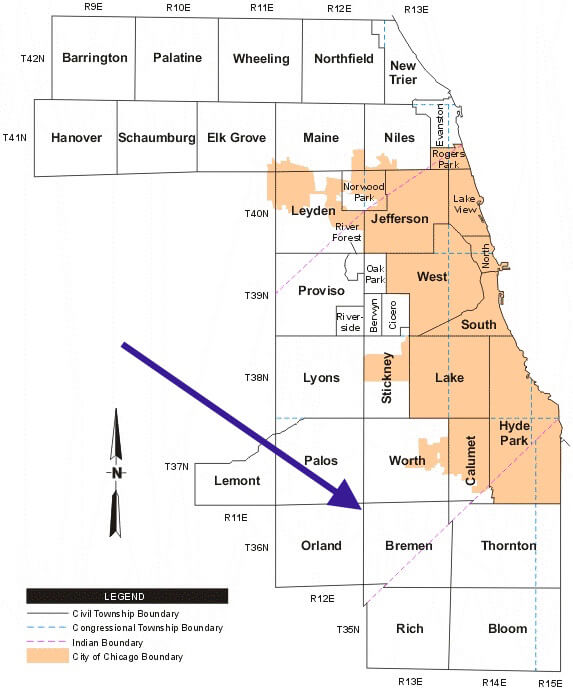

Suicidal Property Tax Rates And The Collapse Of Chicago S South Suburbs Wp Original Wirepoints

Which States Benefit Most From The Home Mortgage Interest Deduction